north dakota sales tax online

Depending on local municipalities the total tax rate can be as high as 85. Maximum Local Sales Tax.

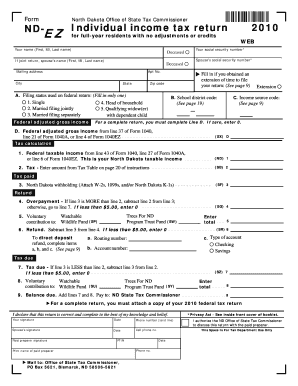

North Dakota Office Of The State Tax Commissioner Fill Online Printable Fillable Blank Pdffiller

Any seller which conducts business and has a major presence within the state must collect sales tax in North Dakota must pay taxes to the state.

. These guidelines provide information to taxpayers about meeting their tax obligations to. The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

Office of State Tax. Here youll find information about taxes in North Dakota be able to learn more about your individual or business tax obligations and explore history and data related to taxes. Registered users will be able to file and remit.

To find a specific form use the search boxes to enter the name of the form select the tax type choose the tax year or include the. 1 years of experience in sales and. So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax.

Exact tax amount may vary for different items. North Dakota State Sales Tax. Local jurisdictions impose additional sales taxes up.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. This permit will furnish your business with a unique sales tax number. Average Local State Sales Tax.

31 rows The state sales tax rate in North Dakota is 5000. You have prior tax accounting experience in a professional services firm preferred. The North Dakota ND state sales tax rate is currently 5.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax. North Dakota has recent rate changes Thu. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

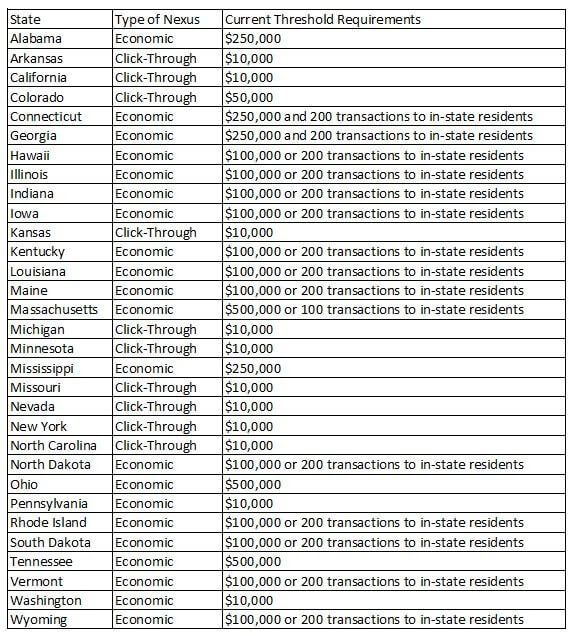

North Dakota is a destination-based sales tax state. North Dakota Tax Nexus. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

This will include all online businesses. Sales Use and Gross Receipts Tax Return to the following address. With local taxes the total sales tax rate is between 5000 and 8500.

Experience with state and local salesuse taxation a plus. Maximum Possible Sales Tax. E-Filing Free Filing.

Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program.

North Dakota assesses local tax at the city and county. 2022 North Dakota state sales tax. Additionally the state reduces the tax rate for business taxpayers purchasing new farm.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. Learn more about different North Dakota tax types and their requirements under North Dakota law.

This allows you to file and pay both your federal and North Dakota. Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST. Forms are listed below by tax type in the current tax year.

The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services.

Welcome To The North Dakota Office Of State Tax Commissioner

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

South Dakota Department Of Revenue Facebook

Historical South Dakota Tax Policy Information Ballotpedia

Covid 19 Drives Huge Spike In Local Sales Tax Revenues Across North Dakota Inforum Fargo Moorhead And West Fargo News Weather And Sports

State By State Guide To Economic Nexus Laws

Supreme Court Rules States Can Collect Sales Tax From Internet Retailers In Historic E Commerce Case Geekwire

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Charitable Registration Harbor Compliance

North Dakota Income Tax Calculator Smartasset

How To File And Pay Sales Tax In North Dakota Taxvalet

How To File And Pay Sales Tax In North Dakota Taxvalet

Sales Use Tax South Dakota Department Of Revenue

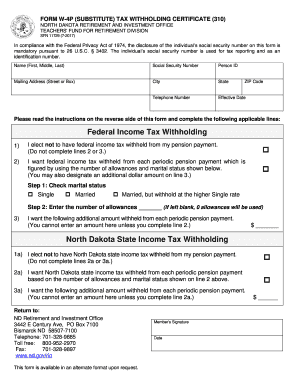

Fillable Online Form W 4p Substitute Tax Withholding Certificate 310 North Dakota Fax Email Print Pdffiller

How To File And Pay Sales Tax In North Dakota Taxvalet

Dot Com Rubble Supreme Court Affirms Online Sales Tax Expansion In Landmark Case Us Tax Financial Services

South Dakota V Wayfair Collecting Sales Tax From Online Sales